what is open end credit agreement

Credit cards are the most common form of open-ended accounts though there are many types. A credit agreement is a legally-binding contract documenting the terms of a loan agreement.

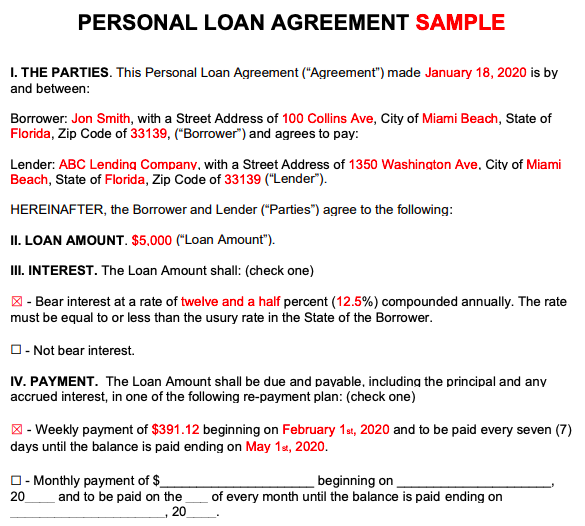

Personal Loan Agreements How To Create This Borrowing Contract

An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit.

. The pre-approved amount will be set out. It is more accurately described as a multi-featured lending plan and consists of the following features. Sample G-24 includes two model clauses for use in complying with 102616h4.

A credit agreement is part of the. Pledged to a company as security for a loan repayment. The finance charge is assessed as of the date credit is extended.

TERMS IN THIS SET 10 Caitlyn has a credit card with a spending limit of 1500 and an APR annual percentage rate of 18. If for example you are a company renting a vehicle and you have 1500000 as a residual value in the agreement and the vehicle is worth 1000000 at the end of the term you will have to pay the difference of 500000 after returning the vehicle to its owner or purchase the vehicle at 1500000. Model clause a is for use in connection with credit card accounts under an open-end not home-secured consumer credit plan.

Subpart AProvides general information that applies to both open-end and closed-end credit transactions including definitions explanations. During the first month Caitlyn charged 375 and paid 250 of that in her billing cycle. Open end credit is a pre-approved loan available from a financial institution.

Also the loan terms cannot be modified. Open-end credit is A. Model clause b is for use in connection with other open-end credit plans.

Open end credit is a pre-approved loan available from a financial institution. See interpretation of this section in Supplement I. Definitions and rules of constructionI The term open end credit plan means a plan under which the creditor reasonably contemplates repeated transactions which prescribes the terms of such transactions and which provides for a finance charge which may be computed from time to time on the outstanding unpaid balance.

An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. Multiple sub-accounts with both open-end and closed-end credit features are added under the one master loan. 6 For purposes of determining coverage under 12 CFR.

Lets examine scenarios with open-end leases at the end of a term. It is made between a person or party borrowing money and a lender. One master loan agreement is signed when the multi-featured plan is first established.

You dont have to make new credit agreements for using the accounts multiple times. Open end credit helps the borrower to control the amount they borrow. An amount of time during which a loan can be repaid without interest.

Open End Credit Closed End Credit Credit Card Company Annual Percentage Rate Credit. If the terms of a credit card account under an open end consumer credit plan require the payment of any fees other than any late fee over-the-limit fee or fee for a payment returned for insufficient funds by the consumer in the first year during which the account is opened in an aggregate amount in excess of 25 percent of the total amount of credit. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages.

How do closed end and open end credit differ. Key points to know about open end credit. Open credit is a pre-approved loan between a lender and a borrower.

See the commentary to 102617 on converting open-end credit to closed-end credit 5. The Cost of Credit. A loan given for a short period of time that is not dependent on credit history.

Open-ended credit or revolving credit gives the borrower an amount to draw from that can be continually reused as its paid. 1 1000 for failure to pay the minimum payment within five days of its due date. A good payment track record can result in an increased credit line to use.

The open-ended promissory note also called a revolving note allows the borrower to set up a line of credit with the lender in the amount specified in the promissory note. Regulation Z is structured accordingly. A closed-end loan allows.

Whereas an open-end loan allows borrowers to continually adjust their borrowing amount and pay back the funds they have used over an indefinite period of time a closed-end loan is far more stringent. 102632 the HOEPA rule clarifies that an open-end consumer credit transaction is the account opening of an open-end credit plan. With closed-end credit debt instruments are acquired for a particular purpose and for a set period of time.

With open-end credit youre only required to make a small minimum payment toward your outstanding balance each month. With closed-end credit both the interest rate and monthly payments are fixed. Once the borrower starts making repayments to the account the money becomes available for withdrawal again since it is a revolving fund.

You can make repeat purchases with an open end credit line. The agreement provides for an interest rate on any. If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening disclosures under 10266 must be given before the consumer becomes obligated on the open-end credit plan.

An advance of funds or a draw on the credit line under an open-end credit plan subsequent to account opening does not constitute an open-end transaction. Unlike open-end credit closed-end credit does not revolve or offer available credit. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage.

Generally speaking there are two primary forms of loans offered to individuals today those being open-end and closed-end loans. The difference between these two types of credit is mainly in the terms of the debt and how the debt is repaid. The blended approach is not an MFOEL plan.

A line of credit is a type of open-end credit. A combined time depositcredit agreement with a financial institution that establishes a time deposit account and an open-end line of credit. Open-end credit agreements are also sometimes referred to as revolving credit accounts.

However the interest rates and terms vary by company and industry. An agreement with an institution on a certain amount that can be repeatedly borrowed. 2 050 minimum finance charge on balances less than 3334.

An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. Video of the Day. Open end credit A pre-approved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

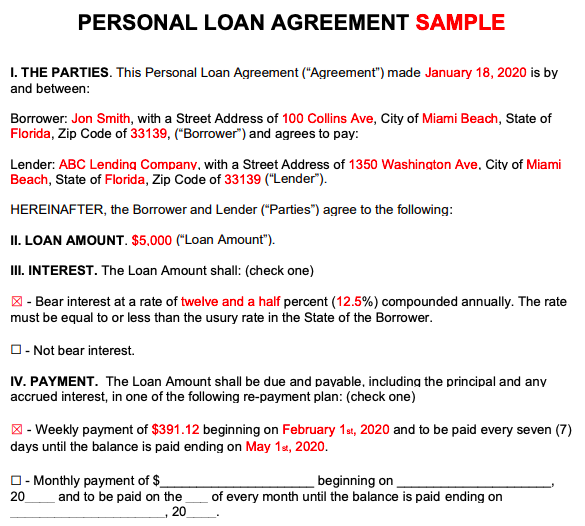

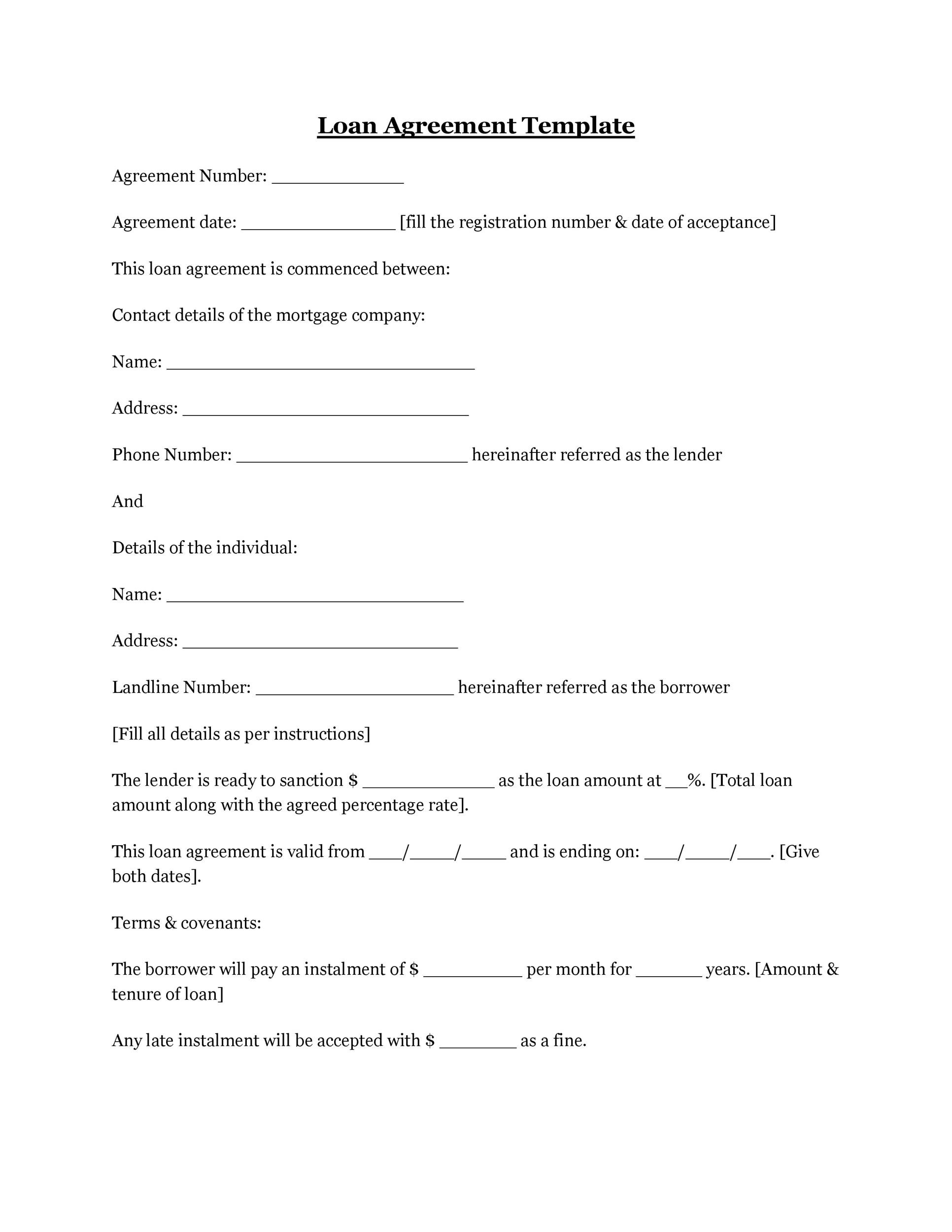

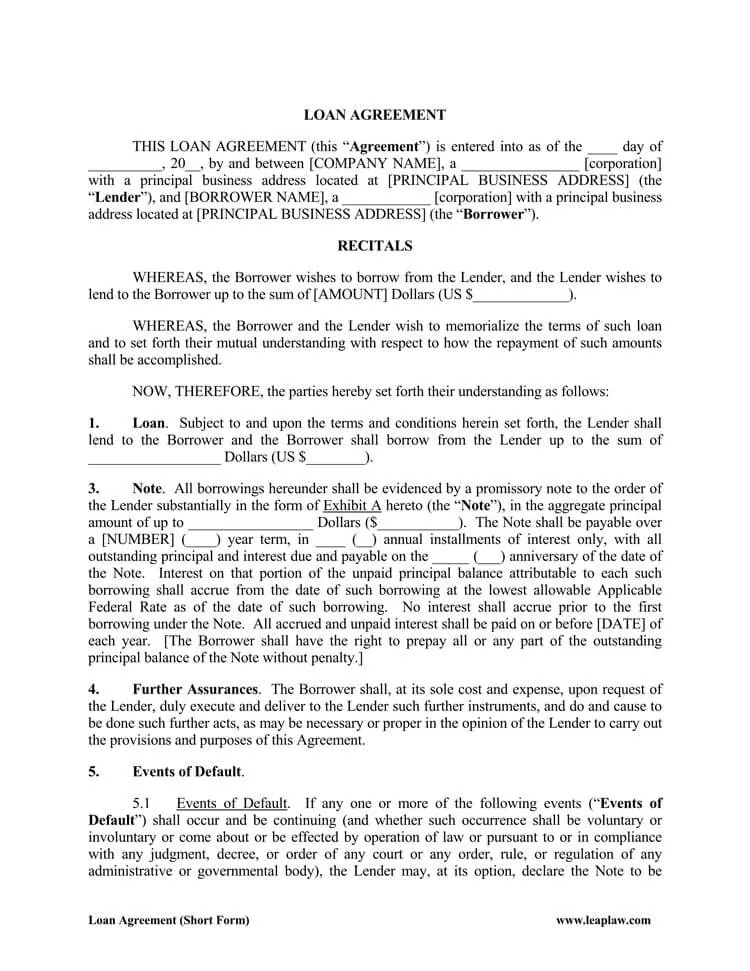

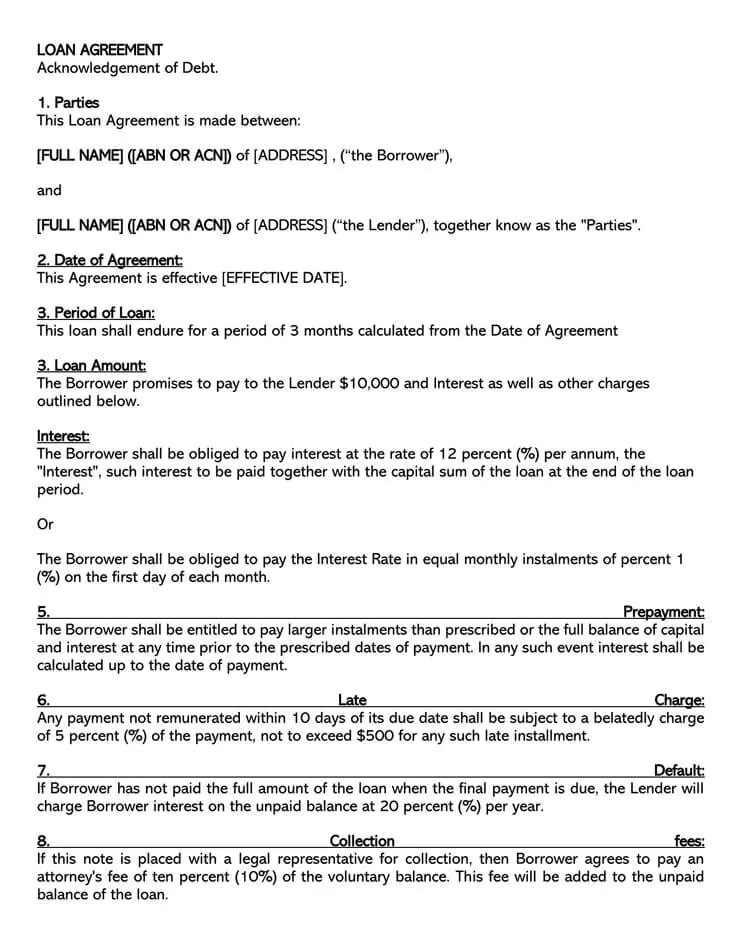

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

38 Free Loan Agreement Templates Forms Word Pdf

Open End Credit Definition Bankrate Com

Free Personal Loan Agreement Template Sample Word Pdf Eforms

38 Free Loan Agreement Templates Forms Word Pdf

45 Free Loan Agreement Templates Samples Word Pdf

38 Free Loan Agreement Templates Forms Word Pdf

45 Free Loan Agreement Templates Samples Word Pdf

Free Seller Financing Addendum To Purchase Agreement Word Pdf Eforms

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Understanding Finance Charges For Closed End Credit

Free Personal Loan Agreement Template Sample Word Pdf Eforms

What Is Open End Credit Experian

:max_bytes(150000):strip_icc()/HomeEquityLoan-28f7772161904a07b6115929ab1ed76c.jpeg)

/GettyImages-917891912-a3aea31808e640578a57ccabd93c055d.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)